Regulatory Compliance

The Logistic Software Market is significantly influenced by the need for regulatory compliance. As governments worldwide implement stricter regulations regarding transportation, safety, and environmental standards, logistics companies are compelled to adopt software solutions that ensure adherence to these regulations. In 2025, the logistics sector is expected to face increased scrutiny, with compliance costs potentially rising by 15%. Consequently, logistics software that offers features for tracking compliance and managing documentation is becoming essential. This necessity drives demand for innovative solutions within the Logistic Software Market, as companies strive to mitigate risks associated with non-compliance and enhance their operational integrity.

Rising E-commerce Demand

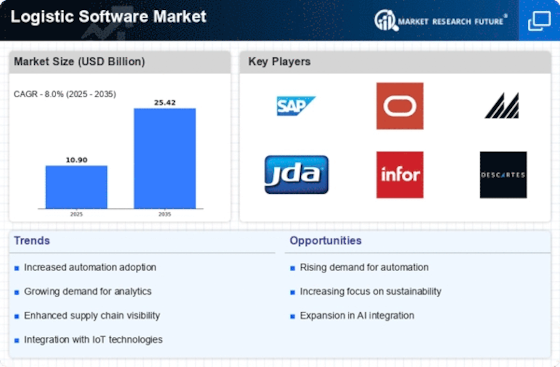

The Logistic Software Market is experiencing a notable surge due to the increasing demand for e-commerce solutions. As online shopping continues to gain traction, businesses are seeking efficient logistics software to manage their supply chains effectively. In 2025, the e-commerce sector is projected to reach a valuation of over 6 trillion USD, necessitating advanced logistics solutions to handle the complexities of order fulfillment, inventory management, and last-mile delivery. This trend is driving investments in logistics software, as companies aim to enhance their operational efficiency and customer satisfaction. The Logistic Software Market is thus positioned to benefit from this growing demand, as firms strive to optimize their logistics processes to meet the expectations of a rapidly evolving marketplace.

Technological Advancements

Technological advancements play a pivotal role in shaping the Logistic Software Market. Innovations such as artificial intelligence, machine learning, and the Internet of Things are transforming logistics operations. These technologies enable real-time tracking, predictive analytics, and automated decision-making, which enhance efficiency and reduce operational costs. In 2025, it is estimated that the adoption of AI in logistics could lead to a reduction in logistics costs by up to 30%. As companies increasingly recognize the value of integrating advanced technologies into their logistics operations, the demand for sophisticated logistics software is likely to rise. This trend indicates a robust growth trajectory for the Logistic Software Market, as businesses seek to leverage technology to gain a competitive edge.

Focus on Supply Chain Resilience

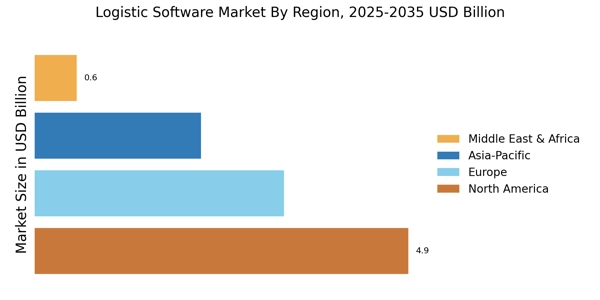

The Logistic Software Market is witnessing a heightened focus on supply chain resilience. Businesses are increasingly aware of the vulnerabilities within their supply chains and are seeking logistics software that can provide greater visibility and flexibility. In 2025, it is anticipated that companies will invest approximately 20 billion USD in technologies aimed at enhancing supply chain resilience. This investment reflects a shift towards proactive risk management and the need for adaptive logistics solutions. As organizations prioritize resilience, the demand for logistics software that can facilitate real-time monitoring, scenario planning, and agile response strategies is likely to grow. This trend underscores the evolving landscape of the Logistic Software Market, where adaptability becomes a key competitive advantage.

Integration of Sustainability Practices

The Logistic Software Market is increasingly influenced by the integration of sustainability practices. As environmental concerns gain prominence, logistics companies are seeking software solutions that support eco-friendly operations. In 2025, it is projected that the market for sustainable logistics solutions will reach 10 billion USD, driven by the need to reduce carbon footprints and enhance operational efficiency. Logistics software that enables route optimization, energy-efficient transportation, and waste reduction is becoming essential for companies aiming to meet sustainability goals. This trend not only reflects a growing commitment to environmental stewardship but also indicates a shift in consumer preferences towards sustainable practices. As a result, the Logistic Software Market is likely to see a surge in demand for solutions that align with these sustainability initiatives.